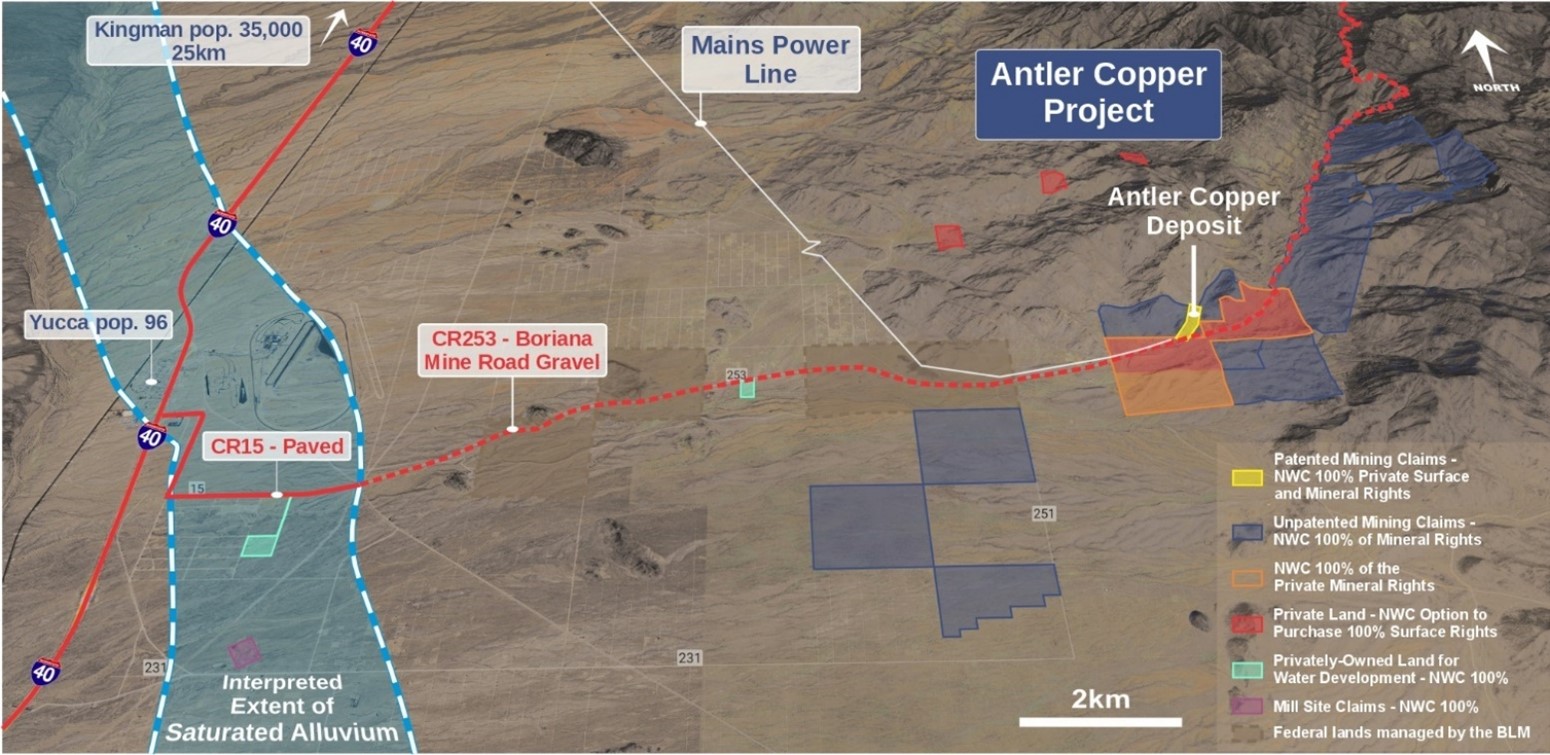

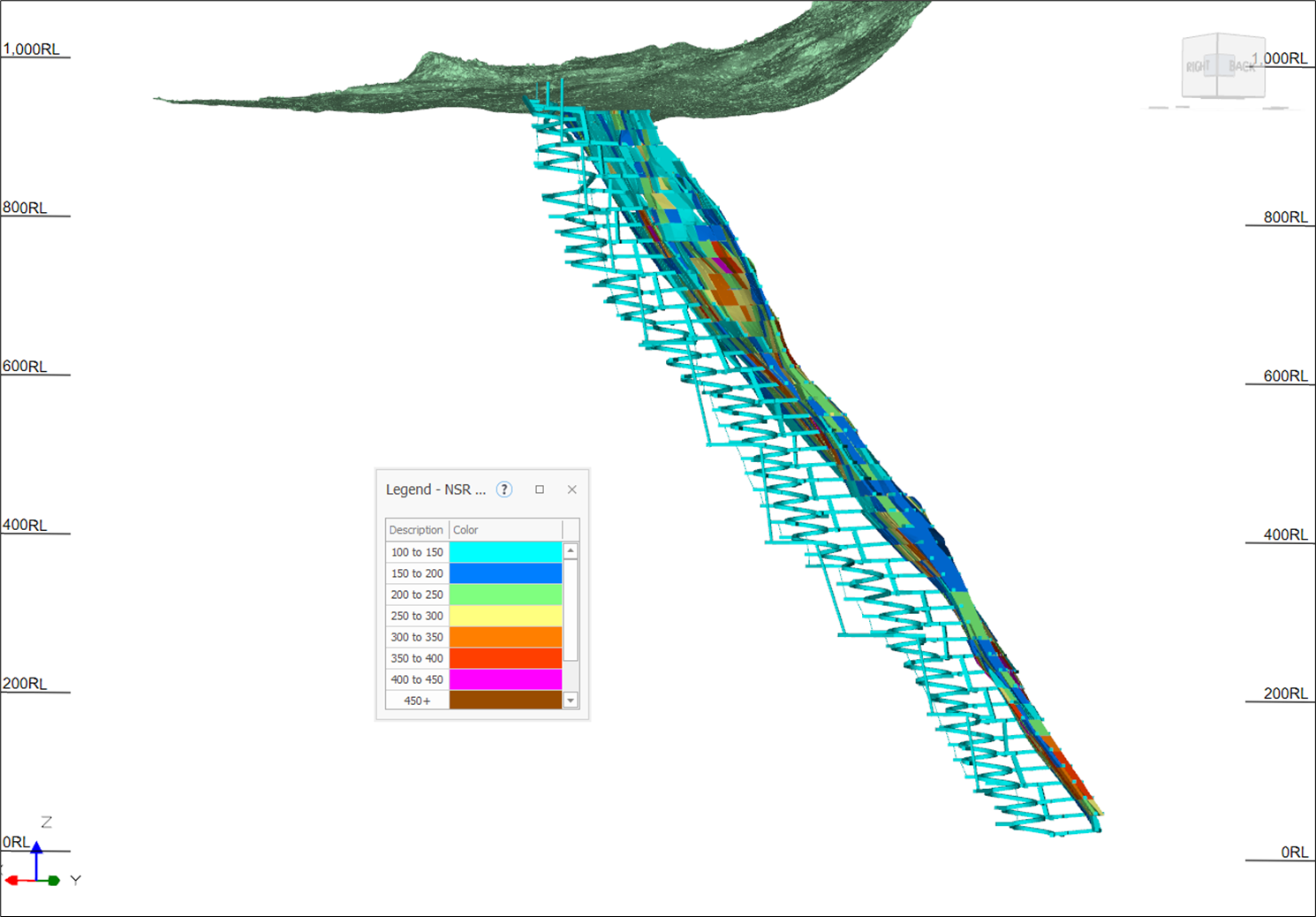

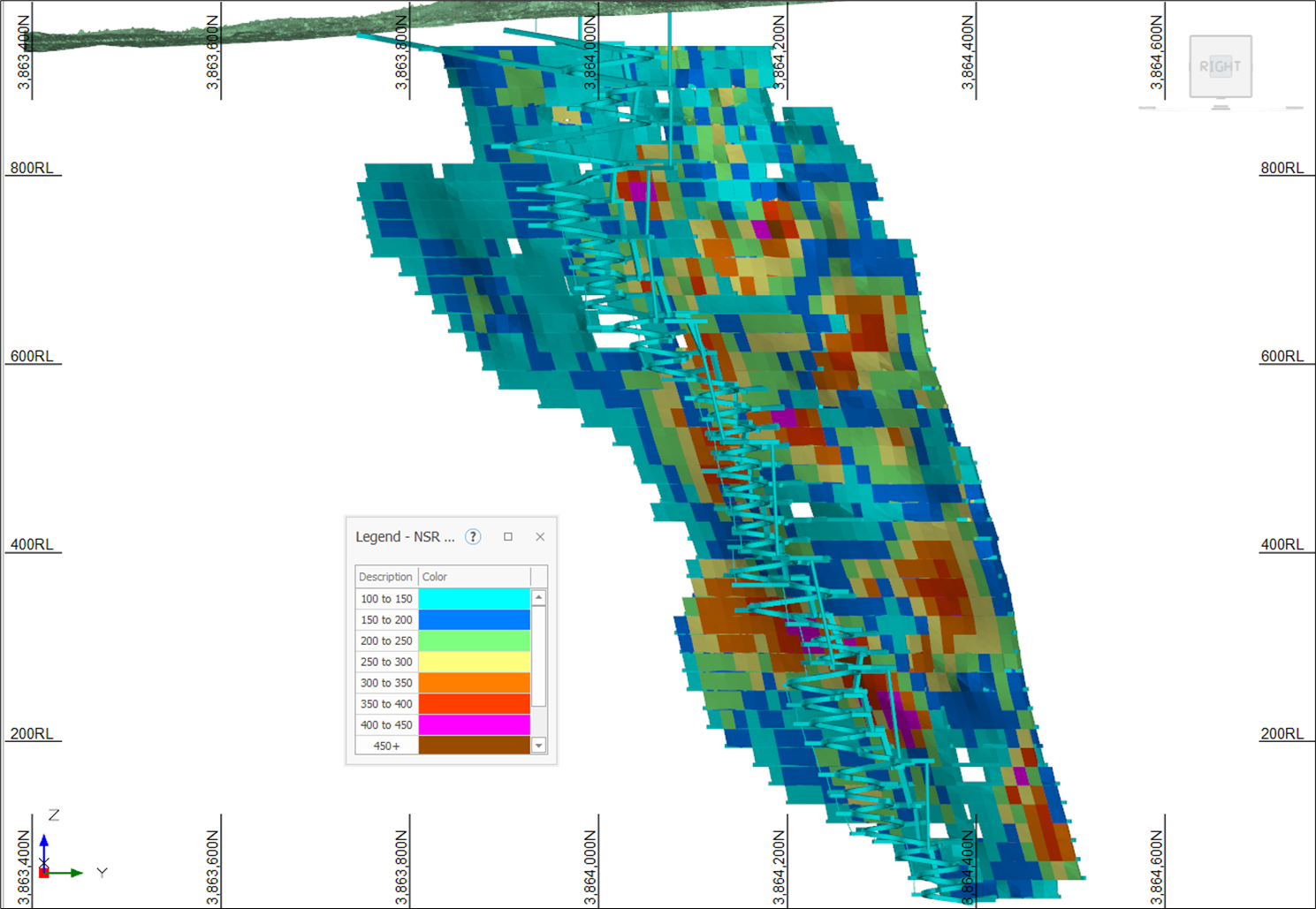

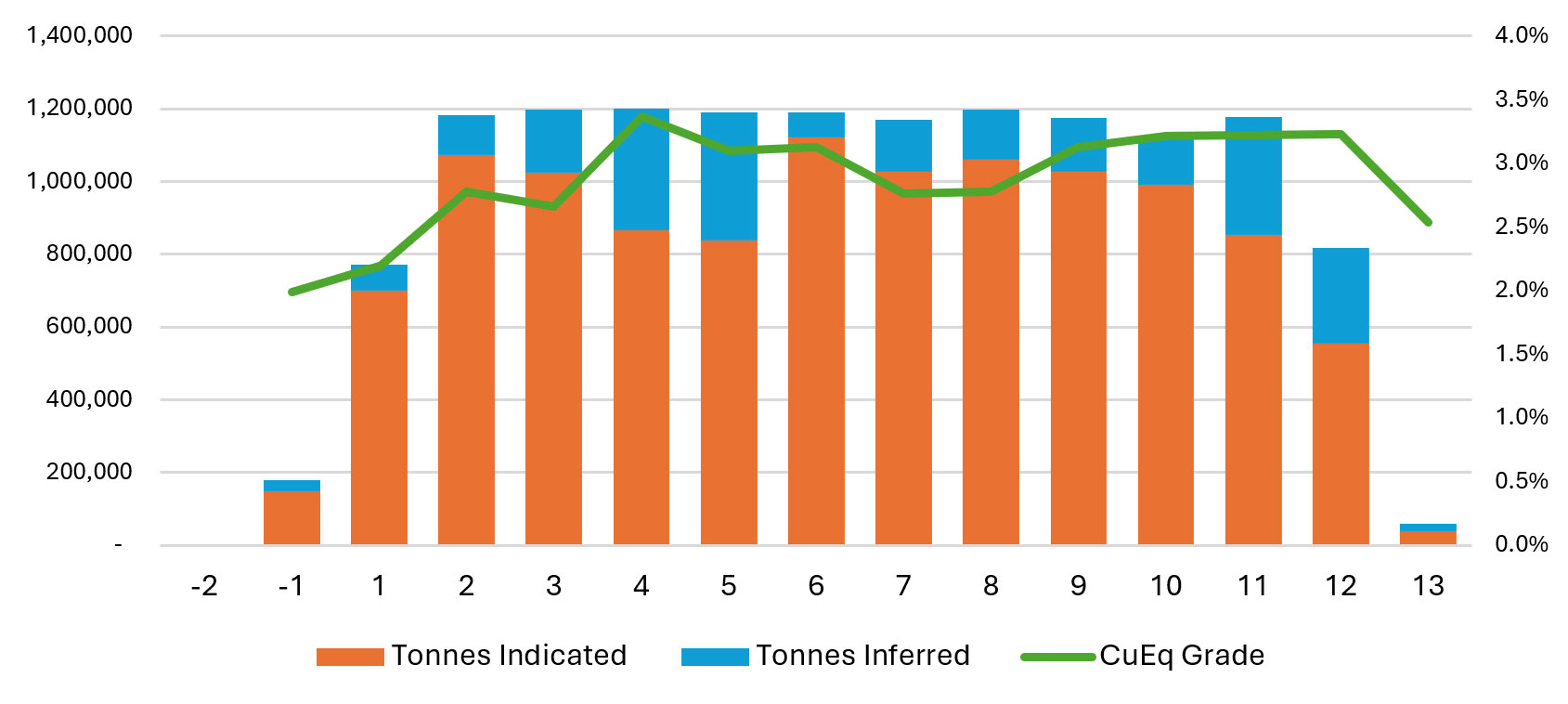

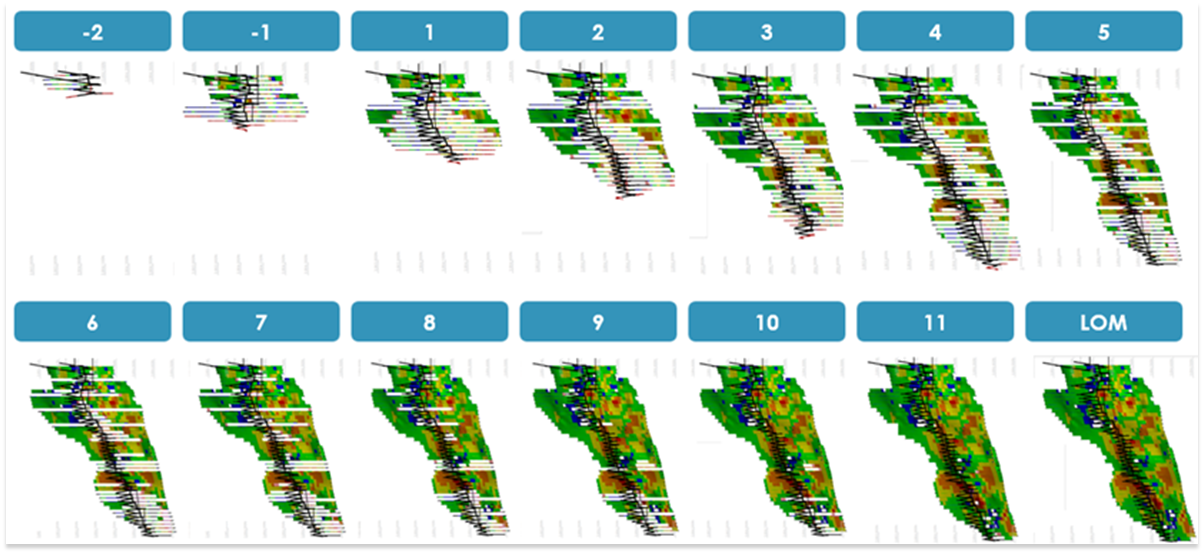

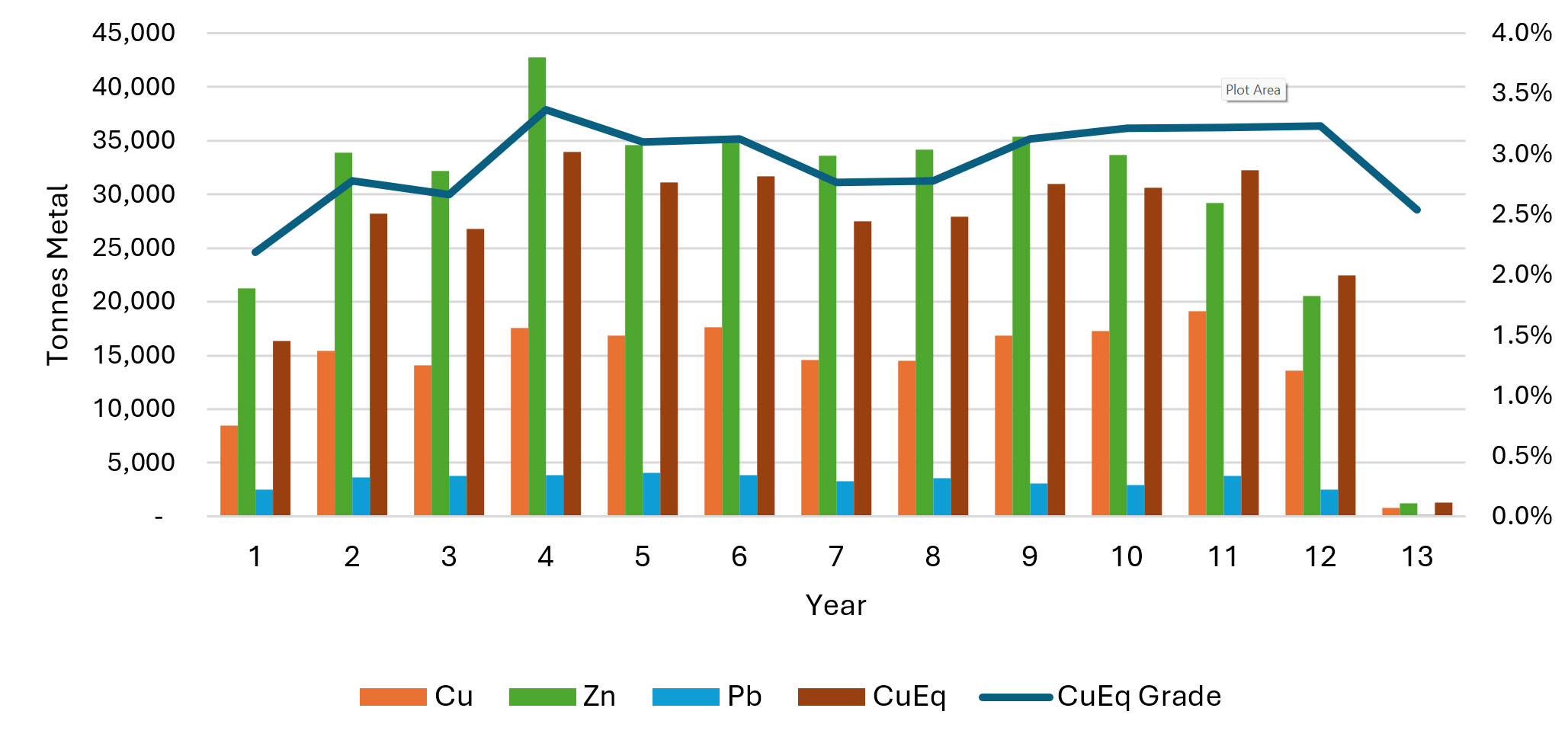

The Antler Copper Deposit is located 15km east of Yucca in northwestern Arizona, USA. It is a high-grade, polymetallic, volcanogenic massive-sulphide (VMS) Cu-Zn-Pb-Ag-Au deposit. Mineralisation outcrops at surface over 750m of strike. The Deposit dips to the west-northwest at around 55ᵒ.

Mineralisation was first discovered at the Antler Deposit in the late 1800s. Mineralisation was subsequently mapped to outcrop over more than 750m of strike. Intermittent mining occurred between 1916 and 1970 during which time approximately 70,000 tonnes of ore were mined at average grades of 2.9% Cu, 6.2% Zn, 1.1% Pb, 31.0g/t Ag and 0.3 g/t Au (~5.0% Cu equivalent).

In January 2020, New World entered into an option agreement to acquire 100% of the Antler Deposit. Following successful initial work programs, in October 2021, it exercised this option.

Prior to completing a PFS in July 2024, New World has drilled more than 150 holes for >60,000m, declared two JORC Mineral Resource Estimates and completed two Scoping Studies.